Car title loans for exotic cars provide quick cash access using the vehicle's appraised value as collateral, bypassing extensive credit checks. Ideal for urgent financial needs or debt consolidation, these loans offer flexible terms and streamlined applications, with specialized lenders optimizing the process to expedite funding for luxury vehicle owners.

“Discover the lightning-fast world of funding your dream exotic car with a car title loan. In an era where time is precious, understanding how these loans work and what speeds them up is crucial. This article breaks down ‘Car Title Loans for Exotic Cars’, exploring key factors that influence funding speed and practical tips to streamline the process. From initial application to funds in hand, learn how to navigate this unique financing path efficiently.”

- Understanding Car Title Loans for Exotic Cars

- Factors Affecting Loan Funding Speed

- Streamlining the Process for Faster Funding

Understanding Car Title Loans for Exotic Cars

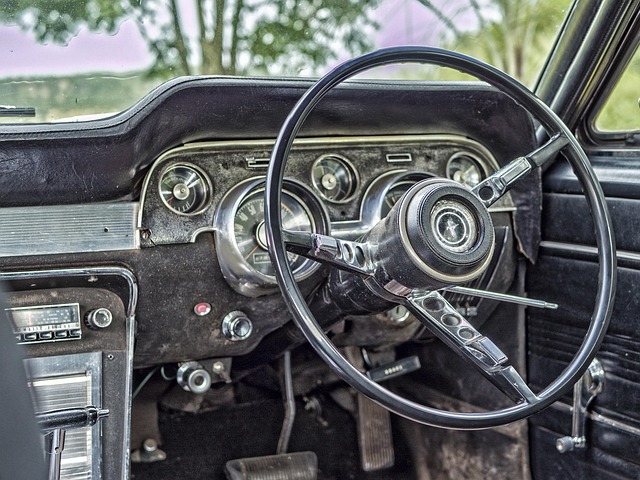

Car title loans for exotic cars are a specialized financing option designed for individuals who own high-end or rare vehicles. These loans allow car owners to leverage the value of their exotic cars as collateral, providing them with quick access to cash. Unlike traditional loans that often require extensive credit checks and stringent eligibility criteria, car title loans focus more on the vehicle’s appraisal value rather than the borrower’s credit history.

This type of loan is particularly appealing for exotic car owners who may need a rapid cash advance or want to consolidate debts. The process involves submitting the car’s title as collateral, with lenders offering a percentage of the vehicle’s estimated worth. Unlike secured loans that require strict adherence to repayment terms, car title loans for exotic cars often come with more flexible terms, making them an attractive option for those who need liquidity quickly.

Factors Affecting Loan Funding Speed

When considering a car title loan for exotic cars, several factors significantly influence how quickly you can access the funds you need. One of the primary determinants is the lender’s evaluation process. These companies must assess the value of your vehicle, which includes the unique attributes and market demand for your specific make and model of exotic car. The faster and more accurately they can determine this value, the quicker they can disburse the loan.

Additionally, the efficiency of their online application system plays a crucial role in expediting funding. Lenders that offer streamlined digital platforms with features like direct deposit enable borrowers to complete the application process from the comfort of their homes. This simplification reduces paperwork and processing time, ensuring that fast cash is within reach for those seeking to fund their exotic car aspirations promptly.

Streamlining the Process for Faster Funding

Many lenders specialize in providing car title loans for exotic cars, knowing that enthusiasts often require quick access to funds. These specialized institutions understand the unique nature of such vehicles and have streamlined the title loan process accordingly. By simplifying application procedures and reducing bureaucracy, they ensure a faster turnaround time.

Additionally, offering flexible repayment options tailored to the needs of exotic car owners is another way to expedite the funding process. With these options in place, borrowers can focus on enjoying their desired vehicle without the immediate pressure of complex repayment plans. This approach not only accelerates funding but also fosters a positive experience for those seeking financial support for their luxurious vehicles.

When it comes to funding your dream exotic car, a car title loan can offer a swift solution. By understanding the process and streamlining certain steps, you can significantly speed up the funding timeline. Several factors influence the time it takes to secure a loan, such as your vehicle’s value, your credit history, and the lender’s policies. However, with efficient preparation and the right approach, you could have the necessary funds in hand in as little as one business day, allowing you to hit the road in style sooner than you think.